CoreLogic November Home Value Index: Australian Property Market Shows Resilience Amid Challenges in the ever-evolving landscape of Australia’s property market, the latest CoreLogic November Home Value Index reveals a nuanced picture of growth, challenges, and regional variations. As mortgage brokers and property investors navigate these complex waters, understanding the current trends is crucial for making informed decisions.

National Overview: Steady Growth Amidst Changing Dynamics

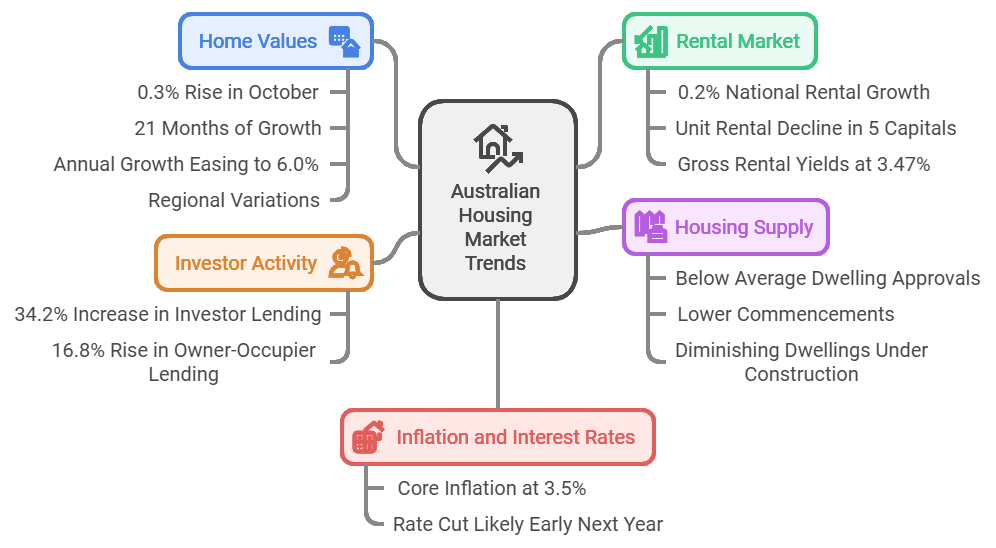

The Australian property market continues to demonstrate resilience, with home values recording a 0.3% increase in October. This marks the 21st consecutive month of growth since the current cycle began in February 2022. However, the annual growth rate has moderated to 6.0%, down from its peak of 9.7% nine months ago. This deceleration suggests a market that is finding a new equilibrium amidst changing economic conditions.

Regional Variations Paint a Diverse Picture

The national figures mask significant regional differences across Australia’s property landscape:

- Perth Leads the Pack: The Western Australian capital emerged as the standout performer, with a robust 1.4% monthly increase.

- Mixed Results in Major Cities: While some capitals experienced growth, others saw declines. Darwin (-1.0%), Canberra (-0.3%), Melbourne (-0.2%), and Sydney (-0.1%) all recorded slight drops.

- Sydney’s Shift: Notably, Sydney experienced its first month-on-month decline since January 2023, with the downturn particularly pronounced in the premium market segments.

Market Dynamics: Supply, Demand, and Sales Trends

The slowing pace of home value growth coincides with several key market indicators:

- Increased Stock Levels: There has been a noticeable rise in advertised property stock.

- Declining Sales Volume: The number of home sales appears to be tapering off.

- Serviceability Challenges For Finance: Currently serviceability buffer of 3% and cost of living pressures are impacting on the availability of finance and credit for home buyers and investors

These trends suggest a market that is becoming more balanced between buyers and sellers, potentially offering more opportunities for those looking to enter the property market.

Rental Market: A Mixed Bag

The rental sector presents a complex picture:

- National Rebound: Rental growth nationally saw a modest uptick of 0.2% in October.

- Unit Rental Challenges: Interestingly, unit rentals declined in five out of eight Australian capitals over the past quarter.

- Yield Pressure: Gross rental yields are facing downward pressure, currently sitting at 3.47% across the combined capitals.

Investor Activity Remains Strong

Despite the challenges of rising holding costs and lower yields, investor interest in the housing market remains robust:

- Lending Growth: The value of lending to investors has surged by 34.2% over the past year.

- Outpacing Owner-Occupiers: This growth is more than double the 16.8% increase seen in owner-occupier lending.

This continued investor confidence suggests underlying strength in the market, despite the moderation in growth rates.

Economic Outlook and Market Projections

Several factors are likely to influence the property market in the coming months:

- Inflation and Interest Rates: With core inflation at 3.5% and price growth slowing, there’s speculation about a potential rate cut early next year.

- Labour Market: Tight labour markets continue to provide support for housing demand.

- Supply Constraints: Limited housing supply is expected to help stabilise prices.

Construction Sector Challenges

The construction industry faces ongoing hurdles:

- Below-Average Approvals: Dwelling approvals remain below historical averages.

- Declining Commencements: The trend in new project commencements is on a downward trajectory.

- Reduced Construction Activity: The number of dwellings under construction is diminishing.

These factors point to a potential supply crunch in the future, which could have significant implications for property values and rental markets.

Implications for Property Investors

For first home buyers and property investors, the current market conditions present both challenges and opportunities:

- Regional Focus: The divergent performance of different cities and regions highlights the importance of local market knowledge.

- Investor Opportunities: Strong investor lending growth suggests continued opportunities in this sector, despite yield pressures.

- Rental Market Strategies: The mixed performance in the rental market requires careful consideration for property investors.

- Long-term Supply Considerations: The constraints in new housing construction may lead to supply shortages, potentially supporting property values in the long term.

Conclusion

The CoreLogic November Home Value Index paints a picture of an Australian property market that is resilient yet evolving. While growth has moderated, the market continues to show strength, particularly in certain regions. For mortgage brokers and property investors, staying informed about these trends and understanding their implications will be key to navigating the market successfully in the coming months. As we move forward, it will be crucial to monitor economic indicators, policy changes, and local market dynamics. The potential for interest rate cuts, combined with ongoing supply constraints, suggests that the Australian property market may continue to offer opportunities for well-informed participants.

Source: CoreLogic Home Value Index Report 1 November 2024